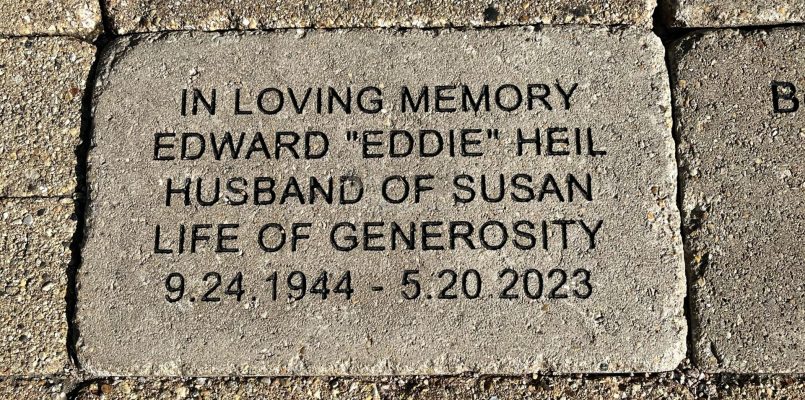

Join the Armour Heritage League with a gift to the Angel Harvey Family Health Center of the Infant Welfare Society of Chicago through estate planning options.

The Armour Heritage League has been established by the Board of Directors to recognize and honor those people who have provided for IWS through their estate plans. Estate gifts are generally designated for an investment fund to benefit the IWS health center in perpetuity.

The continued growth of the investment fund is a key element in the fulfillment of our mission. The Armour Heritage League members truly recognize the future needs of the organization.

Generous donors may find that they can make a very significant contribution through the use of one of the several techniques available for estate planning.

Wills and Bequests . . . You can specify a dollar amount, specific assets, or specify a percentage of your estate and name the beneficiary of your living trust. You may also want to name IWS a contingent beneficiary of a bequest intended for a surviving loved one, in the event the person does not survive you.

Gift Stock/Mutual Funds . . . Gifts of long-term appreciated stock and mutual fund shares are an easy way to make a lasting contribution to IWS. Benefits may include:

Income Tax Savings . . . For securities you have owned for more than one year, you can take an income tax deduction for the full market value, up to 30 percent of your adjusted gross income. The excess can be carried forward for up to 5 years.

Capital Gain Tax Savings . . . Avoid capital gain taxes you would have incurred if you had sold the stock or mutual fund shares.

Outright Gifts of Assets and Retained Life Estates . . . Gifts that may be given outright include long-term, appreciated stock, mutual fund shares, and real estate. Both cash and non-cash gifts offer certain tax advantages, while allowing IWS to use the gift immediately. When real estate is given, the donor may retain a “life estate” and live on the property during his/her lifetime.

Many donors find giving appreciated assets to be a particularly attractive way to make a donation because they are supporting IWS at a lower cost than when making a cash gift.

Please speak with your advisors about the benefits of these options.